SECURE 2.0 Student Loan Match - Decrease Student Loan Debt and Build Retirement Savings

In October of 2023, the moratorium on student loan repayment was lifted and Americans with outstanding student loans began making payments again on their $1.76 trillion of student loan debt. (1) With 40% of workers still owing money on their student loans and the majority of that number owing more than $10,000, student loan debt has a huge impact on many Americans. (2)

Many borrowers must make financial sacrifices because of student loan payments. For example, according to a study by Betterment at Work, nearly two-thirds (64%) of workers with student loan debt said their debt impacted their ability to save for retirement, and 61% of borrowers with children have put their retirement plans on the back burner to help pay for their children’s education.(3) Workers whose retirement savings take a back seat to student loan payments may find themselves in a tough spot when it comes time to retire.

The SECURE 2.0 Act of 2022 provides an avenue for employers to help employees save for retirement while those employees make their student loan payments. (4) The student loan matching provisions of SECURE 2.0 enables employers to offer matching retirement contributions to 403(b) plans on the basis of qualified student loan payments. This option allows employees to save for retirement while paying off their student loans without having to choose between the two.

Benefits to Employers and Employees

Offering a student loan match for employees can provide a competitive advantage in recruiting and retaining top talent. Employees are rewarded for making their loan payments and are introduced to retirement plan participation early in their careers.

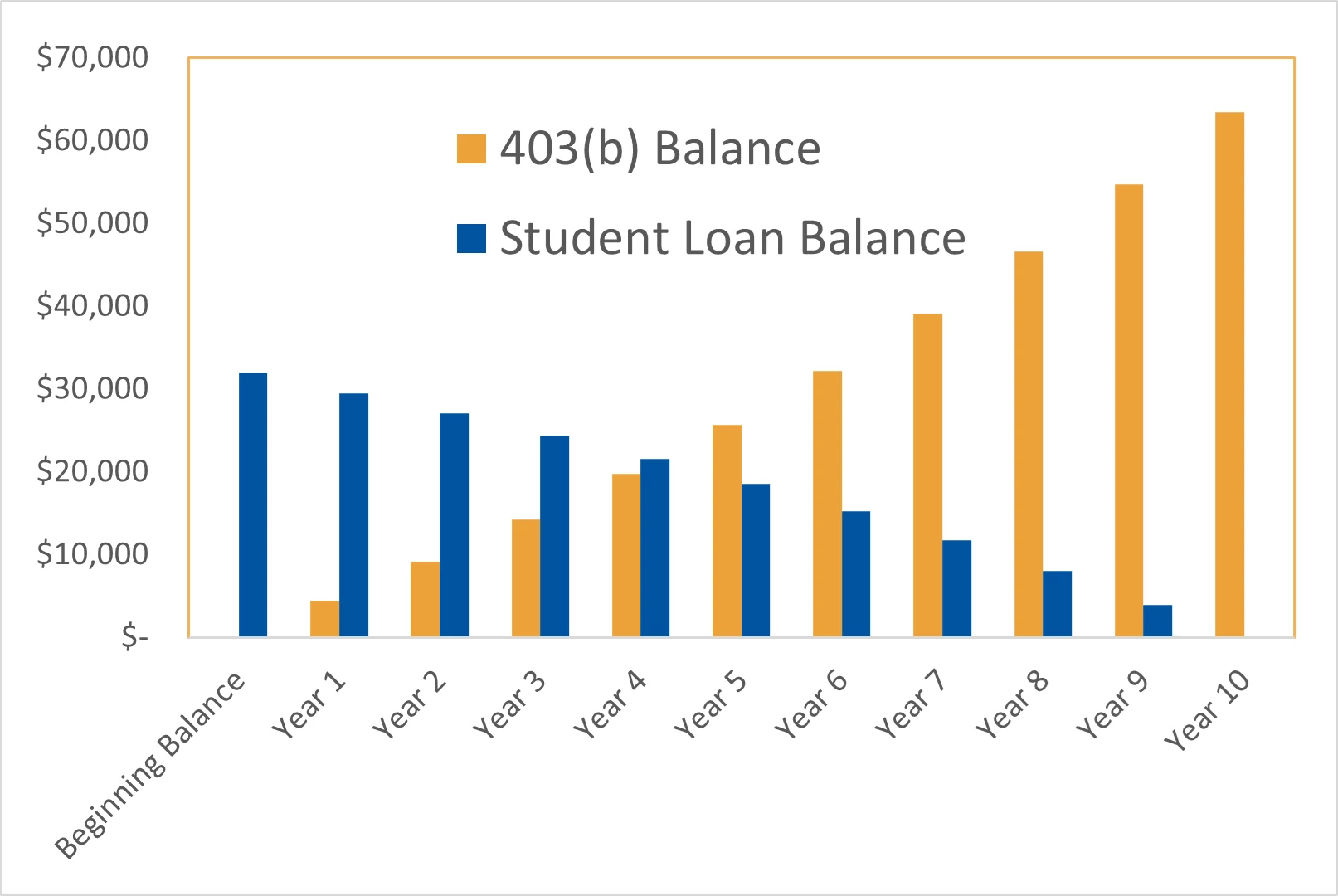

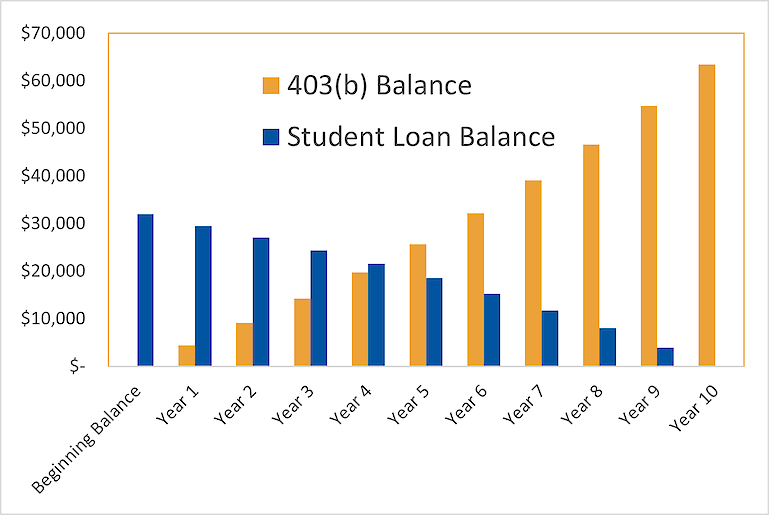

The following example demonstrates how the new rule allows employees to receive a match to grow their retirement plans if they actively pay their student loans. It assumes the employee is not contributing to his or her 403(b), is paying $371/month on a $32,000 student loan with a 7% interest rate, and is receiving a $350/month employer match to the 403(b) plan with an 8% return.

Change to Minnesota Law

Until recently, Minn. Stat. § 356.24 precluded Minnesota school districts and other Minnesota governmental employers from providing retirement plan matches on the basis of student loan payments. However, Aviben worked with state legislators to amend the statute to align with the student loan match provisions of SECURE 2.0. Governmental employers are now able to offer the student loan match under SECURE 2.0.

Introducing Aviben’s New Benefit Solution

Aviben is introducing a new benefit solution in response to the student loan matching provisions of SECURE 2.0. Anticipated for release prior to the beginning of the coming school year, this solution builds upon Aviben's existing ACS software, which assists employers in administering 403(b) plans and staying in compliance with relevant rules and regulations. Employers already using the ACS system will have access to the new student loan feature integrated into the existing software.

© 2024 Educators Benefit Consultants, LLC – 1995 E. Rum River Dr. S, Cambridge, MN 55008. All Rights Reserved. This illustrative example may not be accurate depending on market performance, yield fluctuations, and other factors. There are no guarantees regarding investment performance, and this document does not constitute exhaustive analysis or legal advice.

[1] “The Retirement Readiness Annual Report: A Survey of Employee Retirement Readiness, Financial Wellness, and Benefits Needs and Expectations in 2023,” Betterment at Work, January 18, 2024.

[2] Id.

[3] Id.

[4] Adam S. Minsky, “If You Work And Have Student Loans, These New Benefits Could Help,” Forbes, January 4, 2024.

[5] Id.