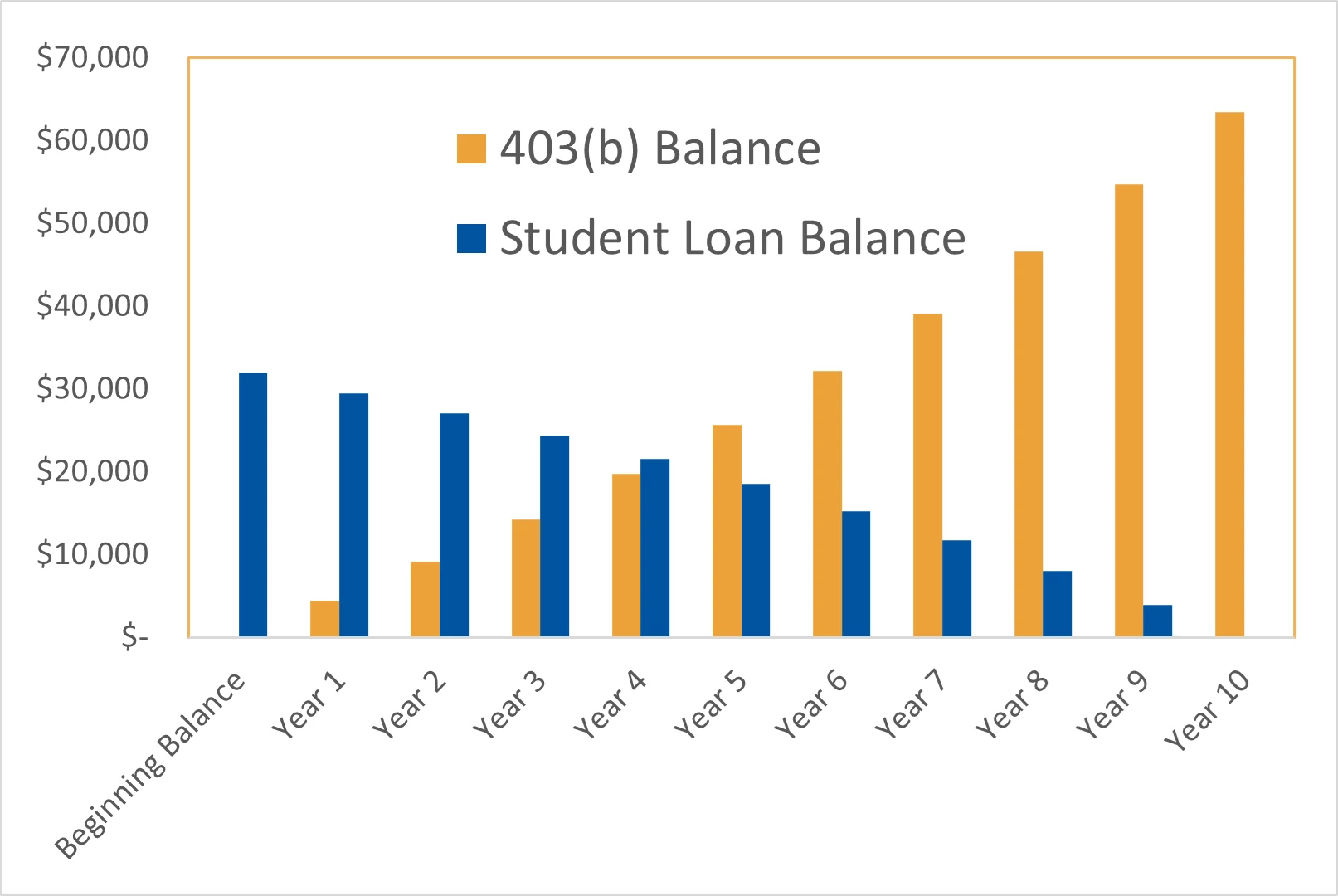

With the rising burden of student loan debt, many employees face the difficult challenge of saving for retirement while also making loan payments. For employers looking to attract and retain top talen...

With student loan payments set to resume, many Americans are facing the financial strain of once again factoring these payments into their monthly budgets. The financial burden is particularly heavy f...

As we move past the halfway point of 2024, it’s an ideal time to revisit your financial plans and ensure you’re on track for the coming year. If a mid-year checkup wasn’t on your agenda this sum...

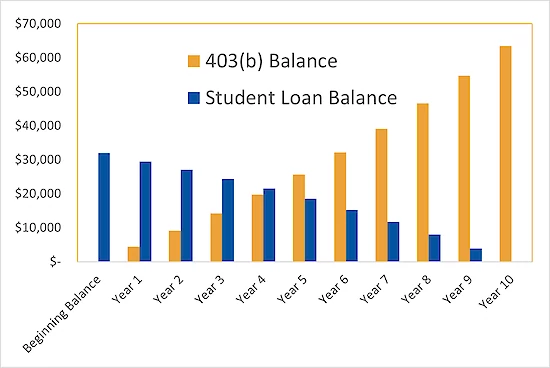

In October of 2023, the moratorium on student loan repayment was lifted and Americans with outstanding student loans began making payments again on their $1.76 trillion of student loan debt. (1) Wit...

Flexible spending accounts (FSAs) are great for expenses like prescription drugs, eyeglasses, and doctor's appointments. However, when individuals do not use all their funds, they typically lose their...

Hustle culture is out. Quiet quitting is in. Quiet quitting is a viral new term that describes the act of only working within your job description. What is quiet quitting? Quiet quitting is not re...

Tax Benefits of Health Savings Accounts (HSA) Did you know that tax advantages are considered the most significant benefit of an HSA account? While 401(k)s, 403(b)s, and individual retirement accoun...

Even with great health insurance coverage, the out-of-pocket costs of care really add up! Co-pays, deductibles, prescriptions.... even dental and vision care expenses can take a big chunk out of a fam...

A health savings account (HSA) allows you to pay for braces and save 20-30% on your hard-earned money. Learn more about how an HSA can be used on your orthodontia expenses. ...

Flexible Spending Accounts (FSAs) are a no-cost benefit offered by your employer that can help you save money by allowing you to pay for qualified out-of-pocket healthcare expenses on a pre-tax basis....