Access your benefit accounts 24/7 with the easy and intuitive Aviben Mobile App. Ask your HR Representative for instruction on how to download the mobile app, available on iOS and Android. ...

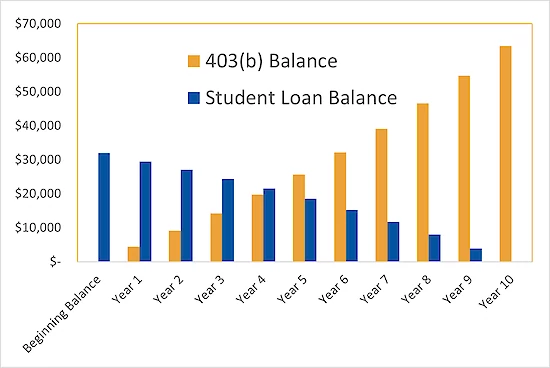

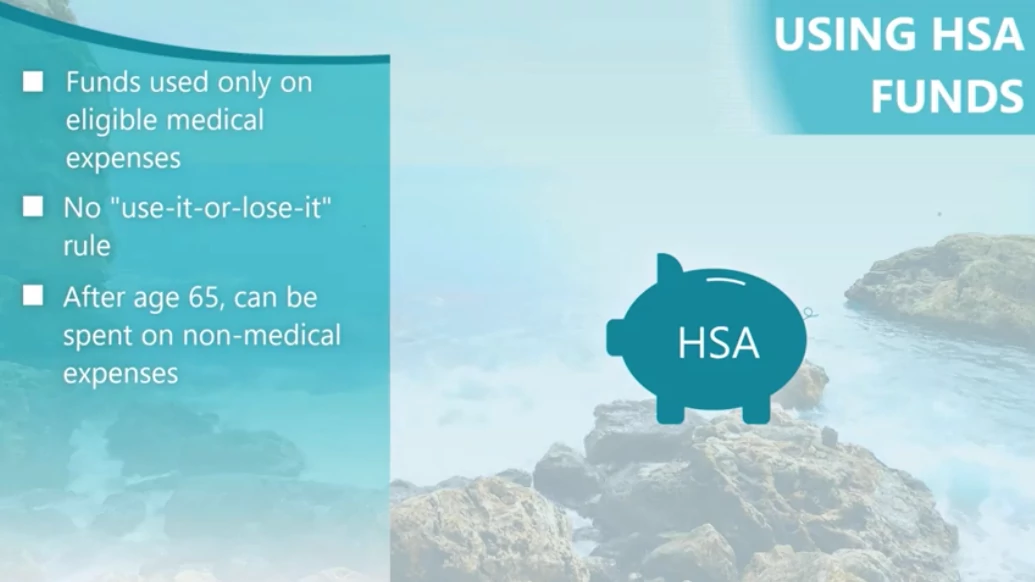

HSAs are tax-advantaged accounts that let you save pre-taxed dollars for future qualified medical expenses. Over time as your account grows you can invest in mutual funds tax-free—and funds never ex...

Flexible Spending Accounts (FSAs) are a no-cost benefit offered by your employer that can save you money by allowing you to pay for qualified out-of-pocket healthcare expenses on a pre-tax basis. Beca...

Dependent Care FSAs are tax-advantaged accounts that let you use pre-tax dollars to pay for eligible dependent care expenses. A qualifying ‘dependent’ may be a child under age 13, a disabled spous...

Flexible Spending Accounts (FSAs) are a no-cost benefit offered by your employer that can help you save money by allowing you to pay for qualified out-of-pocket healthcare expenses on a pre-tax basis....

A health savings account (HSA) allows you to pay for braces and save 20-30% on your hard-earned money. Learn more about how an HSA can be used on your orthodontia expenses. ...

Even with great health insurance coverage, the out-of-pocket costs of care really add up! Co-pays, deductibles, prescriptions.... even dental and vision care expenses can take a big chunk out of a fam...