SECURE 2.0 Student Loan Match White Paper

A detailed guide to the legal and operational aspects of student loan match programs for employers,

third-party administrators, benefits brokers, attorneys, and consultants

SECURE 2.0 Student Loan Match Flyer

STUDENT LOAN MATCH ADMINISTRATION

It’s no secret that student loan debt weighs heavy on the minds and pocketbooks of many, and changes in the law give employers a new approach for helping ease this burden. Under SECURE 2.0, an employer can treat an employee’s student loan payments as employee contributions for purposes of qualifying for the employer’s retirement plan match.

Offering a student loan match for employees can provide a competitive advantage in recruiting and retaining top talent. Employees are rewarded for making their loan payments and are introduced to retirement plan participation early in their careers.

AVIBEN'S SOLUTION

Aviben has developed a proprietary solution that makes administering the student loan match simple. Employers can choose between a payroll deduction model integrated into Aviben’s existing retirement plan administration system and an employee certification model in which employees certify their student loan payments on an annual basis. Either way, Aviben will ensure that the student loan match program is effective and compliant.

Under the payroll deduction model, employees complete a salary reduction agreement authorizing their student loan payments to be made directly from their paychecks. Under the employee certification model, employees complete an online Annual Certification certifying the student loan payments that they made during the year.

THE VALUE TO EMPLOYEES

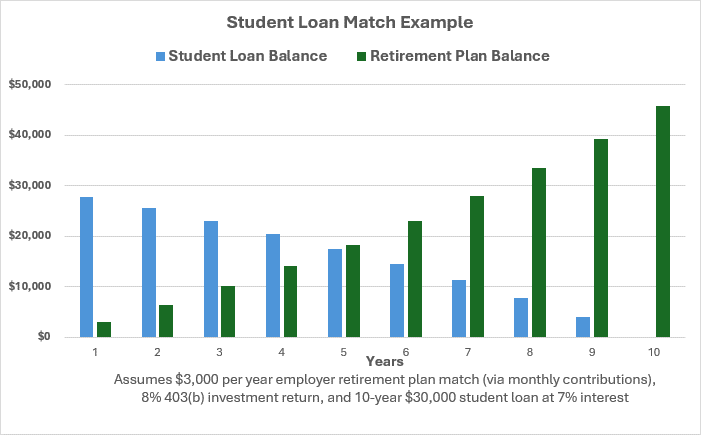

This example demonstrates how the new rule allows employees to receive a match to grow their retirement plans if they actively pay their student loans. It assumes the employee is not contributing to their retirement plan, is making payments on a 10-year $30,000 student loan at 7% interest, and is receiving a $3,000 per year employer match via monthly contributions with an 8% return.

LET AVIBEN BE YOUR GUIDE

Contact Aviben to see how you can leverage this benefit, and please reference our SECURE 2.0 Student Loan Match White Paper for an overview of the student loan match requirements and Aviben’s solution.

Phone: 855-369-5518 or 763-689-0111

Email: acssupport@aviben.com