Key Student Loan Dates and Deadlines for 2024: A Critical Opportunity for Employers

With student loan payments set to resume, many Americans are facing the financial strain of once again factoring these payments into their monthly budgets. The financial burden is particularly heavy for employees who may already be balancing other living expenses in a fluctuating economy.

For employers, this presents a unique opportunity to support their workforce through tailored benefits. Programs like student loan matching, recently reinforced by the SECURE 2.0 Act, can play a pivotal role in enhancing employee retention and satisfaction. Leveraging these benefits not only strengthens a company's position as a competitive employer but also demonstrates a tangible commitment to supporting employees’ financial well-being.

Key Dates for 2024: What Employers Should Watch For

Several critical dates loom in 2024 as student loan payments resume. Understanding these timelines allows employers to align their benefits strategy with employees' financial needs:

October 2024: For many borrowers, this marks the end of the CARES Act forbearance period, meaning monthly payments will resume. Employers should expect that employees' financial stress may increase around this time as they adjust to this added financial obligation.

December 31, 2024: Borrowers who have taken advantage of income-driven repayment (IDR) plans may see changes to their payment terms. This date represents the deadline for recalculating payments based on income, which could also impact disposable income and financial stress.

Employers who are proactive about supporting their employees during these milestones can set themselves apart as partners in their workforce’s financial wellness journey.

Aviben’s Student Loan Match Program: A Powerful Retention Tool

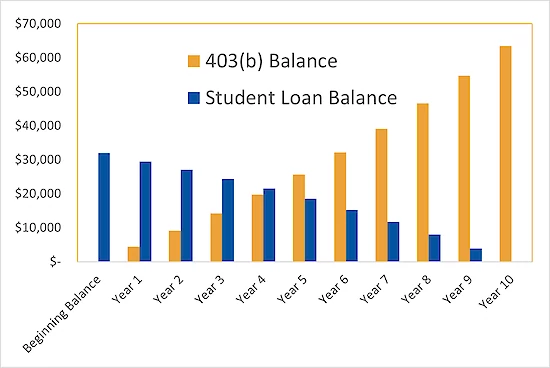

The SECURE 2.0 Act introduced a significant development in the way companies can offer student loan support. The Student Loan Match Program enables employers to make contributions to an employee’s retirement plan in amounts that match their student loan payments. This innovative solution addresses two critical financial priorities—debt reduction and retirement savings—simultaneously.

At Aviben, we’ve made it easier for employers to implement these programs. Our Student Loan Match Program offers a streamlined solution, allowing employers to take advantage of the SECURE 2.0 Act provisions while simplifying administration. This program not only helps employees manage their student debt but also serves as a powerful retention tool in today’s competitive job market. By offering this benefit, employers can provide much-needed financial relief to employees whose budgets are stretched thin by monthly loan payments.

Why Now?

With student loan payments resuming and financial pressures mounting, employers have a critical window to step in and offer meaningful support. Employers who fail to offer competitive benefits may find themselves at a disadvantage when it comes to recruiting and retaining top talent, particularly younger employees who are burdened with student loan debt.

By implementing a student loan match program, employers demonstrate that they understand the evolving financial landscape and are committed to helping employees navigate it. This is not just about adding another benefit—it's about addressing one of the most pressing financial issues facing employees today.

Taking the Next Step

As key deadlines for student loan repayments approach, now is the time for employers to take action. By partnering with Aviben, businesses can seamlessly implement a student loan match program that offers real value to employees while enhancing overall financial well-being.

For employers looking to explore how this program can fit into their overall benefits strategy, we invite you to learn more about Aviben’s student loan match program and how it can drive both employee satisfaction and retention. Contact us today to discuss how we can help you support your workforce through this pivotal financial transition.