Employers and Employees Welcome Growth of Student Loan Match Programs

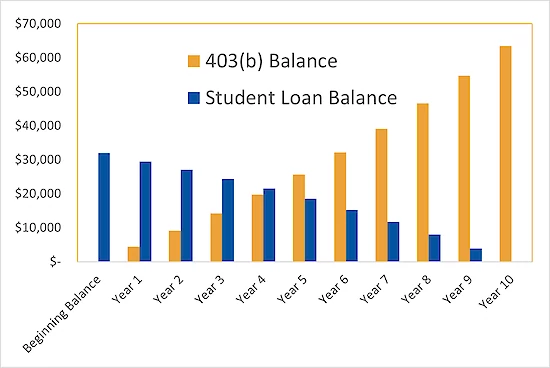

Much has been written about the student loan crisis. Student loan debt in the United States now exceeds $1.75 trillion and data from federal student loans (which represent 92% of all student loan debt) reflects that the student loan crisis is not limited to those early in their careers. Individuals in the 35-49 age group have more federal student loan debt than individuals in the 25-34 age group ($646.6 billion compared to $487.3 billion) and even those age 62 and older account for $121.5 billion in federal student loan debt. Not surprisingly, 84% of student loan borrowers report that their student loans negatively impact the amount they save for retirement.

The student loan match provisions of the SECURE 2.0 Act of 2022 (“SECURE 2.0”) represent a win-win for employers and employees, providing employers an innovative recruitment and retention tool and enabling employees to build their retirement savings while repaying their student loans. Prior to the enactment of SECURE 2.0, employers could only make matching contributions to employee retirement plans based on employees’ own contributions. But SECURE 2.0 now permits employers to treat employee qualified student loan payments—rather than simply employee contributions—as the basis for the employer’s matching contributions to a 403(b), 401(k), government 457(b), or SIMPLE IRA plan. If an employer offers student loan matching, this option allows employees to save for retirement while paying off their student loans without having to choose between the two.

When SECURE 2.0 was first enacted, there were many unanswered questions regarding the administration of student loan match programs. Subsequent IRS guidance has generally addressed these concerns and Aviben has gone a step further by developing a proprietary, industry-leading solution that streamlines student loan match administration.

Aviben’s solution makes administering student loan match programs simple and effective. Employers can choose between two models:

- Payroll Deduction Model: Employees complete a salary reduction agreement authorizing their student loan payments to be made directly from their paychecks. This approach integrates seamlessly into Aviben’s existing retirement plan administration system.

- Employee Certification Model: Employees complete an online Registration Form when they enroll and then complete an Annual Certification certifying the student loan payments they made during the year.

Regardless of the model employers select, Aviben ensures that the student loan match program is compliant and effective. As student loan match programs grow in popularity, employers and employees alike will continue to see significant benefits from these innovative solutions that bridge the gap between retirement savings and student loan repayment.

Ready to get started? Aviben is here to help your organization take advantage of the opportunities offered by student loan match programs. Whether you’re looking for an innovative way to attract and retain top talent or want to give your employees the tools they need to build a brighter financial future, we have the expertise and solutions to make it happen.

Contact us today to learn more about how Aviben can simplify student loan match administration and help your organization stay ahead in an increasingly competitive workforce landscape.

Together, we can make a difference for your employees and their financial futures.