Benefits of Having an HSA: The Triple Tax Advantage

Tax Benefits of Health Savings Accounts (HSA)

Did you know that tax advantages are considered the most significant benefit of an HSA account?

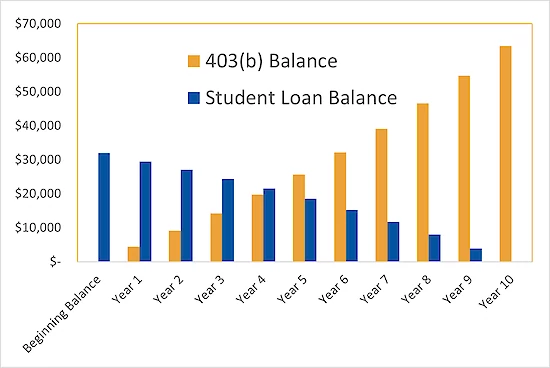

While 401(k)s, 403(b)s, and individual retirement accounts (IRAs) provide some tax advantages, like tax savings at either the time of the contribution or at withdrawal, they do not offer both. HSAs, however, do. Here’s how they work.

- Invest in your HSA with pre-tax dollars. Your tax bill will be lowered because your contributions are deducted from your taxable income. The tax savings equates to your HSA contribution times your marginal rate.

- Your HSA money grows tax-free. Depending on how you use the assets you’ve accumulated, the funds may only be taxed when withdrawn in retirement. This is often at a time when your tax rate is lower.

- HSA money withdrawn is tax-free. Assuming the money is used for qualifying expenses, funds withdrawn may not incur any taxes. The tax savings equates to the HSA funds you withdraw times your marginal tax rate.

With savings like this, HSAs set themselves apart from other accounts and can provide considerable value, especially with significant medical expenses.

Other HSA benefits

The benefits of an HSA don’t end with tax savings! Check out the other ways they can be valuable.

- You can contribute regardless of your income.

- Funds can be taken anytime to pay for a qualifying medical expense.

- Money in an HSA can be withdrawn anytime and is not limited to the same year you contribute to the account.

-You can take HSA funds out for any reason without a penalty once you reach age 65 or older.

- You can leave your money in your HSA as long as you wish, and unlike accounts like 401(k)s, 403(b)s, or traditional IRAs, there are no mandatory required minimum distributions (RMDs).

- An employer may also contribute funds to your account as a matching program.

The many advantages of a health savings account, whether tax-related or otherwise, are clear, making it an excellent option for employees and employers.

This should not be considered an exhaustive analysis or construed as financial, legal, or tax advice. Please reach out to your financial, legal, or tax advisor to determine what is in your best interest based on your specific situation and needs. Aviben® is a third-party administrator of employee benefits and does not provide legal, financial, or tax advice to individuals.