Helping Employees Save for Retirement While Paying Off Student Loans: Aviben’s Student Loan Match Program

With the rising burden of student loan debt, many employees face the difficult challenge of saving for retirement while also making loan payments. For employers looking to attract and retain top talent, addressing this financial strain is crucial. Aviben offers a solution through its Student Loan Match program, which leverages the provisions of the SECURE 2.0 Act to help employees build their retirement savings while repaying student loans.

The Student Loan Dilemma

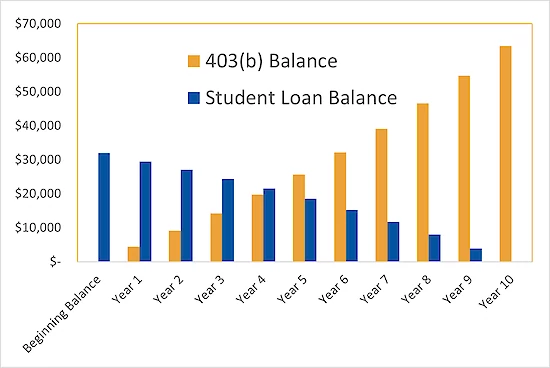

Student loan debt in the U.S. now exceeds $1.75 trillion, with borrowers carrying an average loan balance of nearly $29,000. Employees of all ages—from recent graduates to those nearing retirement—struggle with loan repayment, and many are unable to contribute to their retirement plans due to their student loan obligations. Studies show that 84% of student loan borrowers feel their loans negatively impact their ability to save for retirement.

SECURE 2.0: A Game-Changer for Employers

The SECURE 2.0 Act, passed in December 2022, introduced provisions allowing employers to offer matching retirement plan contributions on account of employee student loan payments. This means employees can now benefit from retirement plan matches based on their qualified student loan payments, helping them save for the future while addressing their current student loan debt.

Aviben’s Student Loan Match Solution

Aviben has developed a streamlined and flexible solution for employers looking to offer this benefit. We provide two models for implementing the student loan match:

Affirmative Certification Model: Employees certify that they’ve made qualified student loan payments at the end of the year, and Aviben processes the corresponding retirement plan match for the employee’s benefit. Aviben’s 403(b) administration customers can access this model at no additional cost.

Payroll Deduction Model: Aviben offers a payroll deduction system where employees’ loan payments are withheld from their pay and automatically remitted to their loan servicer. In return, the employer provides an ongoing retirement match without the need for annual certifications or additional paperwork. The employer is able to verify that the loan payments have been made, and the employee receives a monthly (as opposed to an end-of-year) match.

Both models ensure that employees are supported in their financial journey, and employers can integrate this benefit smoothly into their existing retirement plans.

Why Implement a Student Loan Match Program?

By offering a student loan match, employers demonstrate their commitment to the financial well-being of their employees. It’s a powerful recruitment and retention tool that helps employees reduce debt while building their retirement nest egg. For employees, this program offers relief from the financial strain of balancing loan repayment with long-term savings.

Aviben: Your Partner in Retirement and Student Loan Solutions

Aviben has the expertise to support employers in implementing SECURE 2.0 student loan match programs. Whether you’re looking for a simple certification process or a comprehensive payroll deduction model, we have the tools and knowledge to make it work for your organization.

Check out the Student Loan Match page on our website, where you can find the Student Loan White Paper authored by Aviben General Counsel Trent Pepper and our Student Loan Match Employer Flyer.

Contact Aviben today to learn more about how our Student Loan Match program can benefit your employees and your business.