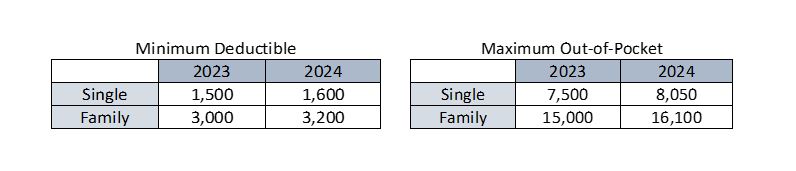

If your insurance is a high deductible health plan (HDHP) that meets the minimum deductible and maximum out-of-pocket criteria, then you may be eligible to make contributions to a tax-free HSA.

To open an HSA you must be enrolled in a high deductible health plan (HDHP). Your health insurer can verify whether you have such a plan.

You cannot contribute to your HSA if you are enrolled in Medicare or if you have any disqualifying coverage.

You may be covered by any one of the following types of insurance without being disqualified from contributing to an HSA:

- Accident, disability, vision, dental, cancer, or long-term care insurance

- Limited-purpose or post-deductible flexible spending account (FSA)

- Limited-purpose or post-deductible health reimbursement arrangement (HRA)

Distributions from an HSA are tax-free to the extent that they offset unreimbursed medical expenses of the account holder or his or her spouse or dependents.

An HSA account holder is permitted to take distributions for any purpose; however, if a distribution is not used for qualified medical expenses, the distribution is included in the account holder's gross income for tax purposes and generally is subject to a 20% penalty.

Once enrolled in Medicare, a person is no longer eligible to make contributions to an HSA but may continue taking tax-free distributions for medical expenses. Once an individual reaches age 65, distributions used for purposes other than qualified medcial expenses are taxable but are not subject to the 20% penalty.

Individuals with an HDHP and an HSA may still participate in an employer-sponsored section 125 cafeteria plan offered through Aviben. You may continue to flex for your dependent/daycare expenses and your outside health insurance. You may also continue to flex for some of your medical out-of-pocket expenses through a limited-use FSA if your employer amends your cafeteria plan to include that option.

If an account holder dies, amounts remaining in the HSA transfer to the beneficiary named in the HSA beneficiary designation form or, if none is named, the funds transfer according to the terms of the HSA trust or custodial account agreement. If the beneficiary is the surviving spouse, the spouse becomes the account holder and the transfer is not taxable. If the beneficiary is anyone other than the surviving spouse, the HSA ceases to be an HSA and the funds are taxed.

You cannot designate a personal checking account as your HSA. An HSA must be established by signing a trust or custodial account agreement with a qualified trustee or custodian that manages the account in accordance with IRS regulations.